Service hotline

+86 0755-83975897

Release date:2021-12-28Author source:KinghelmViews:613

Due to the uncertainty of the Sino-US trade war, China's manufacturing industry has a sense of crisis in the component supply chain, and domestic substitution has entered the fast lane.

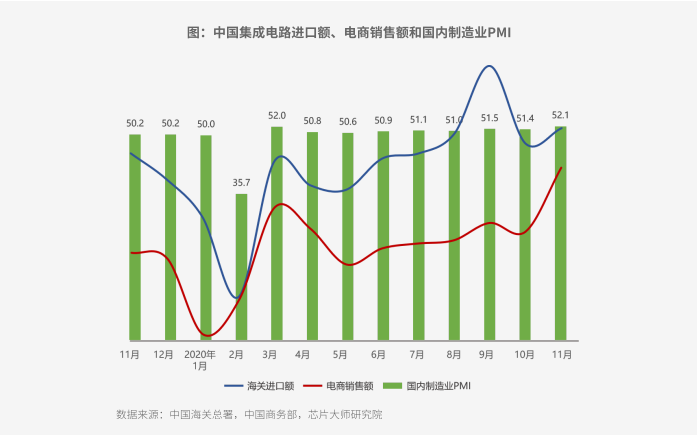

As of the end of November 2020, data released by the General Administration of Customs of China showed that mainland China imported a total of 2,202.5 billion integrated circuits (about 336.1 billion US dollars, about 352.8 billion US dollars in 2019), a significant increase of 15.2% over the same period last year. The corresponding import volume was 489.38 billion pieces, a substantial increase of 22.6% over the same period last year.

Chip Masters Research Institute predicts that the import value of integrated circuits in 2020 will reach a record 356.6 billion US dollars.

Judging from the data of the past 13 months, the two peaks of integrated circuit imports occurred in March and September, and there has been a steep upward trend in November.

The Chip Masters Research Institute retrieved China's manufacturing purchasing managers' index (PMI) data over the same period, of which the index in March and November exceeded 52%, hitting a peak since September 2017. The superposition reflects that since February, with the normalization of work resumption and epidemic prevention and control, domestic integrated circuit trade and downstream manufacturing demand have continued to be strong.

Due to the uncertainty of the Sino-US trade war, China's manufacturing industry has a sense of crisis in the supply chain, and domestic substitution has entered the fast lane.

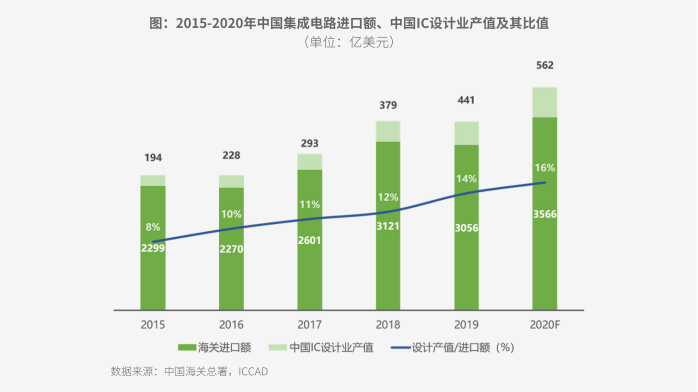

Statistics from the General Administration of Customs of China show that from 2015 to 2020, my country's integrated circuit treasury increased from US$229.9 billion to US$356.6 billion, with a compound annual growth rate of 7.6%. During the same period, ICCAD data showed that the sales of IC design industry increased from US$19.4 billion to US$56.2 billion, with a compound annual growth rate of 19.4%, and the yuan was higher than the import value. At the same time, the ratio of IC design industry to import value increased from 8% to 16%, which fully shows that Chinese chip manufacturers are growing rapidly and expanding their share.

In 2020, there are a total of 2,218 chip design companies in my country, a year-on-year increase of 24.6%. Industry-wide sales are expected to be 381.94 billion yuan ($56.2 billion per month), a year-on-year increase of 23.8%. 289 companies are expected to have sales of more than US$100 million, a year-on-year increase of 21.4%. In terms of separate fields, the largest increase in the number of companies is in the fields of communication, analog and consumer electronics.

At the same time, SIA (Semiconductor Industry Association) also released a report on the global market share of Chinese chips. Data analysis shows that the global market share of Chinese chips is only about 5%, far less optimistic than the 13% data predicted by ICCAD.

Here, the Chip Master Research Institute refers to the commodity transaction data of the total number of 500+ Chinese component companies in Lichuang Mall. Its total sales in 2020 will account for about 5.9%, which is basically in line with SIA's analysis and forecast. At the same time, it also shows that the number of Chinese component companies using e-commerce for digital pioneering is still very small, and it is urgent to strengthen and deepen.

2020 China Component E-commerce Annual Survey

Following the detailed investigation in 2019 (see [China Components E-commerce White Paper (2019 Edition)]) and analysis of the industry, occupation, and online purchasing habits of Chinese e-commerce users, the Chip Master Research Institute will combine the epidemic situation and localization penetration in 2020. , through a survey of the purchasing behavior of about 3,000 mall customers, the following judgments are drawn.

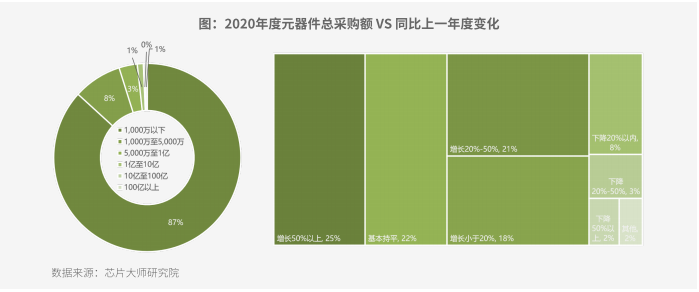

Small and medium-sized customers: purchases have grown significantly

Judging from the annual purchase amount of components by customers, the scale of less than 10 million yuan accounts for 87%, which is typical of small and medium-sized enterprises, scientific research institutes and enthusiasts, representing the procurement needs of small and medium batches, and also in line with the characteristics of e-commerce services. About 63% believe that the purchase amount has increased compared with 2019, of which about 25% believe that the purchase amount has increased significantly by more than 50%, and about 13% believe that it has decreased significantly.

Analysis: On the one hand, the epidemic in 2020 has not weakened the basic demand of the domestic electronics industry. On the contrary, due to the double circulation, the supply chain has increased investment in the majority; on the other hand, it shows that these customers have also increased the scale of online transactions , which provided the basis for the expansion of the proportion of online purchases from 1.5% to 1.82%.

Epidemic: Catalysts for Online Purchasing and Domestic Substitution

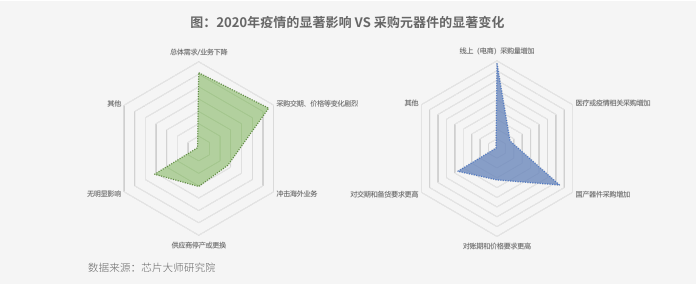

Most customers believe that the impact of the epidemic on the listed institutions is manifested in two aspects: one is the drastic changes in procurement delivery and prices, and the other is the decline in demand and business in some industries. However, a large number of customers commented that the impact period of the epidemic is limited, and even in the first half of the year, the business outbreak caused a surge in demand. The first conclusion above also confirms that the demand for the whole year does not decrease but increases under the normalization of the epidemic.

In addition, two important changes that cannot be ignored are that 56% of customers said that the online (e-commerce) purchases of their institutions will increase in 2020, and 48% of customers said that domestic device purchases have increased. At the same time, under the epidemic, customers generally put forward higher requirements for suppliers to cope with insufficient production capacity, prolonged delivery time and price fluctuations, which is beneficial to spot e-commerce companies with obvious domestic channel advantages and original factories with mature supply chains.

Component e-commerce + domestic substitution: getting better.

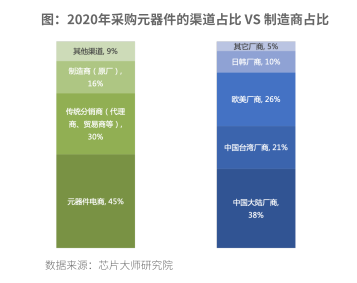

The survey data on customer procurement channels and the proportion of manufacturers shows that the proportion of procurement from e-commerce continues to increase, accounting for 45% (42.7% in 2019, and about 655 in Europe and the United States in the same period), gradually replacing traditional agents and original products. Factory channels have become a limited choice for small and medium customers. 2. In 2020, mainland Chinese manufacturers accounted for 38% (31.8% in 2019), surpassing 26% of European and American manufacturers for the first time.

It shows that the chain reaction brought about by the epidemic has objectively accelerated the localization process of Chinese components, and e-commerce is also becoming an important driver for Chinese chips to expand their market share.

On the contrary, the Chip Master Research Institute estimates that the proportion of Chinese component manufacturers selling through e-commerce channels is only about 10%, which is far from the 80% to 90% "electric shock" ratio of similar foreign manufacturers. The current situation of insufficient online rate in the device industry.

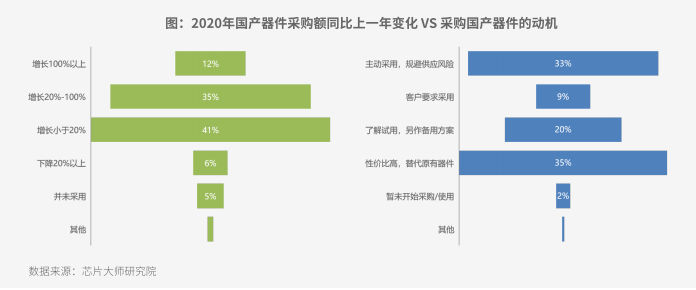

On this basis, purchasing behavior data shows that 88% of customers increased their purchases of domestic devices in 2020, of which 47% accounted for an increase of more than 20% in purchases. In the winter composition, 35% of customers chose domestic devices with higher cost performance to replace the original products, 33% of customers avoided potential supply risks due to trade wars and epidemic factors, and 20% of customers chose to learn about the trial first.

According to the analysis of the Chip Master Research Institute, under the joint stimulation of the new crown epidemic, the international situation and customer demand, 2020 will be a key node for the online procurement of domestic components, the rise of domestic devices and the further expansion of e-commerce channels by domestic original manufacturers. Seizing the opportunity of digitalization and enhancing digital combat effectiveness is a win-win event for the original factory, e-commerce and users.

The most watched chip companies in 2020

Finally, in order to study online users' perceptions of chip manufacturers and brands, the Chip Master Research Institute continued to conduct a series of voting on "200 Years of Your Most Concerned Chip Manufacturer/Brand". / International brands were selected.

Judging from the user voting results, Huawei HiSilicon ranked third in the world's most concerned chip brands for two consecutive years, and Fenghua Hi-Tech and Sunlord Electronics ranked among the world's most concerned passive devices.

In addition, in the three major segments of main control chips, analog devices and power devices, users have once again selected well-known brands that can play the role of "China Chip" in their minds.

Among them, Zhaoyi Innovation, Shengbang Micro and Changjing Technology ranked first in the attention of users of main control, analog and power devices respectively. For the first time, the two domestic giants in the subdivision field, Huawei HiSilicon and Anshi Semiconductor, were shortlisted in the TOP5, which shows the breadth of users who have been deeply cultivated for many years.

6. Capacity and variables of the e-commerce market

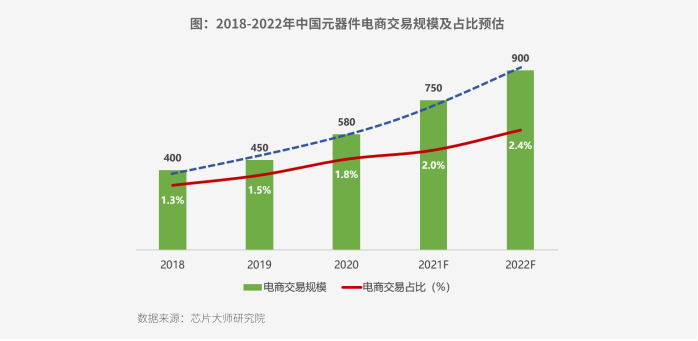

In 2020, the overall scale of components e-commerce in the Chinese market is about 58 billion yuan, accounting for 1.82% of the total component transaction share of 3.2 trillion yuan, and the absolute value has increased by 0.3% year-on-year in 2019.

In 2019, according to the incomplete statistics of the Chip Master Research Institute, a comprehensive evaluation of local e-commerce companies such as a treasure/a cat series (18.5 billion yuan), Lichuang Mall, as well as online sales data of global catalog distributors and agents in China, yuan The transaction scale of device e-commerce in the Chinese market is about 45 billion yuan, accounting for only about 1.5% of the total market share of 3 trillion components. This was mainly due to the shrinking online business of overseas catalog distributors and agents, which dragged down the business growth space in China.

According to the side view, the public data of a global catalog distributor listed company in 2020 shows that its performance growth rate in the Asia-Pacific region is about 30%; the sales volume of a treasure/cat series is about 30 billion yuan; and the growth rate of local component e-commerce companies generally exceeds 50%.

Based on various online sales data, the Chip Master Research Institute estimates that the overall scale of component e-commerce in the Chinese market in 2020 will be 58 billion yuan, accounting for about 3.2 trillion yuan (an increase of 8% over 2019). The total component transaction market share 1.82%, the absolute value increased by 0.3% year-on-year in 2019

In addition, the Chip Master Research Institute predicts that the overall scale of component e-commerce in the Chinese market will reach 75 billion yuan and 90 billion yuan in 2021 and 2022, respectively, corresponding to a total market share of 2.0% and 2.4%.

Due to the curved entry of traditional manufacturing industries such as PCB and SMT, coupled with the online advancement of traditional head component agents, and even the rapid advancement of online business of original manufacturers such as TI, the risks and thresholds of online transactions have become extremely complex and more challenging.

This kind of competition and cooperation relationship between industrial chains may exist for a long time, and the tacit cooperation of fighting but not breaking is maintained. Due to the pressure of the digitalization process and the high threshold, the collaborative space and capabilities of the non-leading enterprise industry groups will gradually expand, and the value of the leading e-commerce platforms will become more prominent.

7. Summary and expectations

2020 will undoubtedly be a milestone harvest year for component e-commerce companies and chip industry players who embrace digital services. Just like the positive side of a coin, how destructive and lethal the epidemic is to the electronics manufacturing industry as a whole is how deep is the infatuation and love for the digitalization of the industrial Internet. In terms of trends, this is only the choice of the times, the choice of value innovation, and the choice of industry efficiency improvement.

In 2020, component e-commerce companies will build industrial chain collaboration systems in various ways, build and expand self-operated warehousing, and improve service quality and stickiness through micro-innovations such as cloud FAE, cloud BOM, and PLUS membership/ERP. Evolution and innovation with Chinese characteristics. Due to the compression of component channel value and capital market cognitive bias, coupled with the very different social and termination capabilities of supply chain services and digital economy services, component e-commerce companies with industrial ecological service capabilities will shine brightly.

What is the essence of the industrial Internet with components as the carrier? It is the informatization, digitization, intelligence and networking in the electronic manufacturing process. Fully integrate the electronics industry with the new generation of information technology in design, R&D, manufacturing, marketing, service, supply chain, data services and other links, and improve the operational efficiency of the entire electronics industry system through collaborative services.

Therefore, the two stages of the industrial Internet, one is cost reduction and efficiency enhancement, the other is order growth, supplemented by mobile phone, processing, calculation analysis and data products of key data to feed back the blind spots and pain points in the industrial chain, win-win symbiosis, and achieve true collaborative development in a sense.

In 2021, the competition of component e-commerce will be more intense. It is very likely that there will be a battle of short-handed handovers at local nodes. New disruptors will be born in the manufacturing and warehousing chains, and there will be new companies at the original factory. Joining the self-operated camp of TI store will also form a new alliance of interests in the capital market.

Perhaps, on Xintuo's track, there will be even larger players laying out and hunting results ahead. The only thing we can be sure of is that this will eventually be a battle for the industrial ecological chain, and it is also a battle for the entry of the industrial digital economy. The smoke of gunpowder is getting thicker, and the good drama has just begun!

Annex I

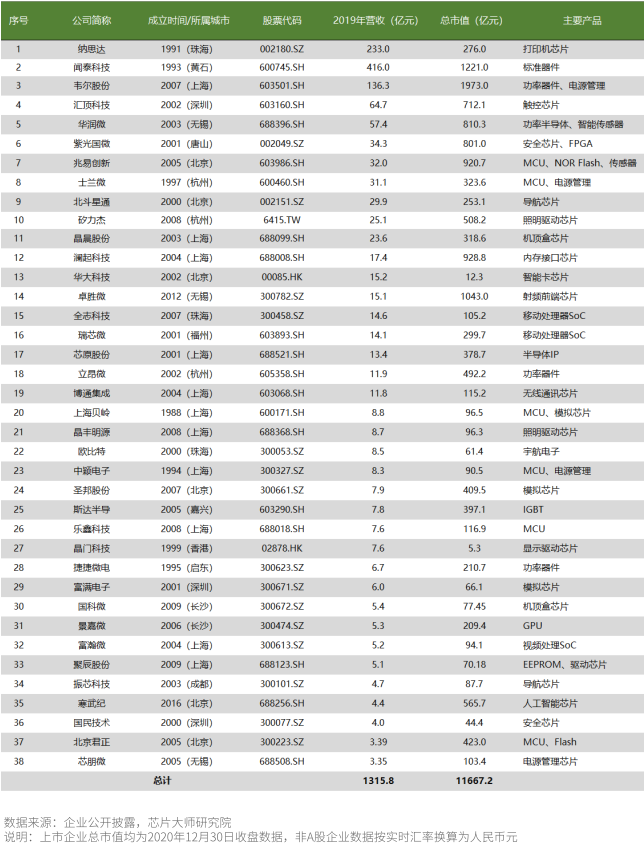

Table: List of China's Major Chip Design Listed Companies in 2020 (38)

Annex 2

Table: 2020 Most Popular Chip Brand Voting Results (Based on 3,000 User Votes)

Annex 3

Table: 2020 Most Popular Chip Brand Voting Results (Based on 3,000 User Votes)

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853