Service hotline

+86 0755-83975897

Release date:2021-12-28Author source:KinghelmViews:810

TWS earphone industry in China -- definition and composition structure

TWS headset is a new intelligent wearable product produced by applying TWS technology to the field of Bluetooth headset. It is mainly composed of charging box and wireless headset.

Definition and working principle of TWS earphone

TWS is the abbreviation of true wireless stereo, which is based on the development of Bluetooth chip. TWS headset is a new intelligent wearable product produced by applying TWS technology to the field of Bluetooth headset.

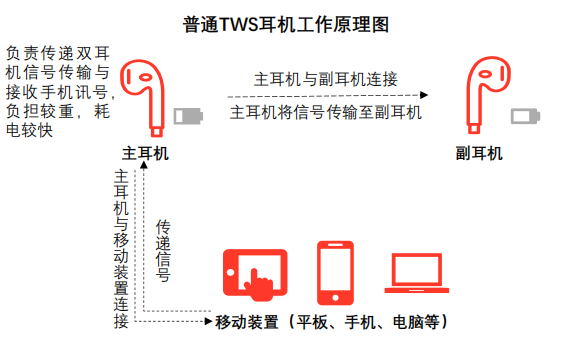

Basic working principle of TWS headsetThe mobile device is connected with the main headset, and then the main headset is connected with the auxiliary headset through Bluetooth wireless mode to form a stereo system, so as to realize the real wireless separation of left and right Bluetooth channels. Since there is no physical wire connection between the left and right units of TWS headphones, TWS headphones are generally not charged by micro USB interface, but by providing portable charging box to provide charging and storage functions.

TWS headset is mainly composed of charging box and wireless headset. The charging box includes lithium battery pack, Power PCB assembly, battery management IC, led charging indicator module and other devices. The wireless headset includes chip (such as Bluetooth chip, power management chip, etc.), sensor (such as acceleration sensor, distance sensor, etc.), battery Microphone and other electronic devices.

China TWS earphone industry - main features

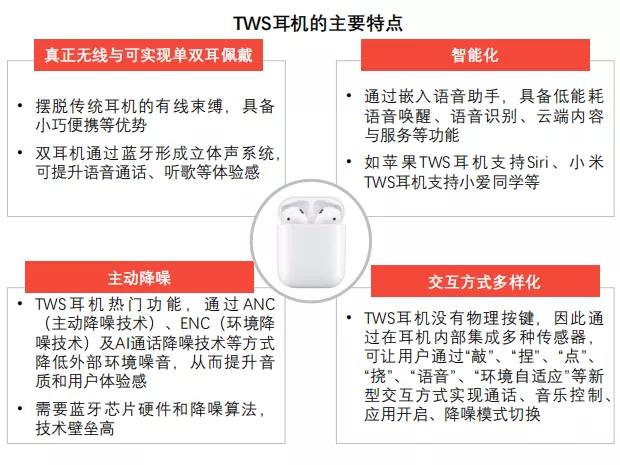

TWS headset has the characteristics of real wireless and can be worn with one or both ears, intelligence, active noise reduction and diversified interaction modes. Compared with traditional wired Bluetooth headset, TWS headset has the advantages of simple design, hands-free and higher wearing convenience

Main features of TWS headset

TWS headphones are truly wireless and can be worn in one or both ears, intelligent, active noise reduction, diversified interaction modes and so on.

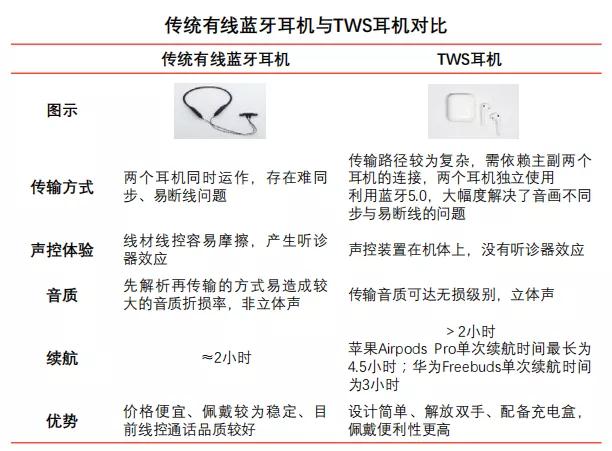

Comparison between traditional wired Bluetooth headset and TWS headset

The following table compares the traditional wired Bluetooth headset with TWS headset in terms of transmission mode, voice control experience, sound quality, endurance and advantages:

China TWS earphone industry - overview of core technologies

TWS headphones mainly involve active noise reduction technology, sensing interaction technology and new generation Bluetooth audio technology, which provide users with noise reduction function, diversified interaction modes and better audio experience respectively

Related technologies of TWS earphone industry in China - active noise reduction technology

The active noise reduction of TWS headphones is realized through the cooperation of hardware (chip, sensor, microphone array, etc.) and software algorithm. It is mainly divided into two core technologies: active noise control and environmental noise reduction.

The noise reduction function of TWS headphones can effectively reduce the impact of external noise on sound quality. Its principle is mainly divided into passive noise reduction and active noise reduction.

Passive noise reduction modeThe earphone blocks external noise by using sound insulation materials such as silicone earplugs or other special structures. Typical passive noise reduction earphones include in ear earphones, large earmuff earphones, etc. The noise reduction cost of passive noise reduction headphones is low, but the noise reduction effect is inferior. Generally, it can only block high-frequency noise, and the noise reduction effect of low-frequency noise is not obvious.

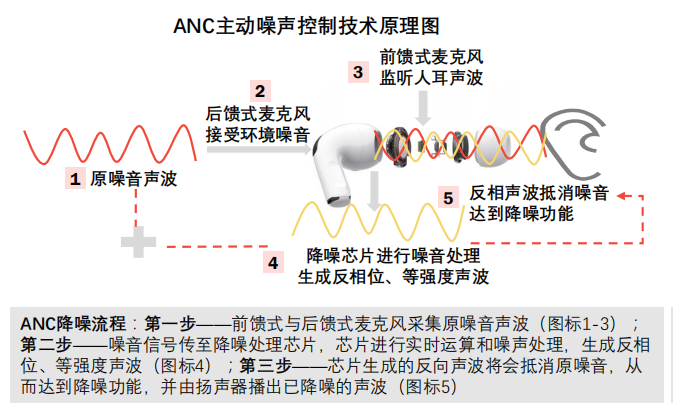

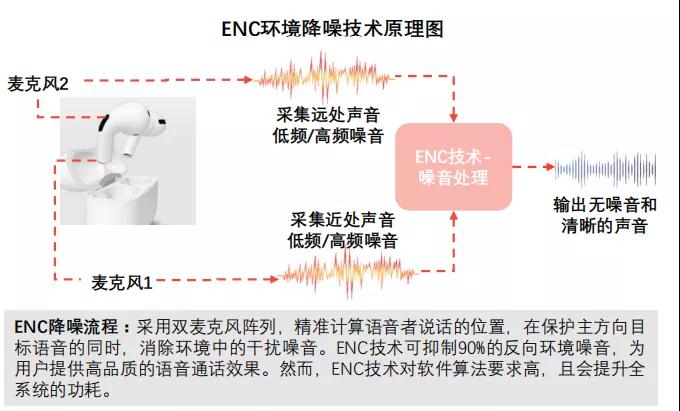

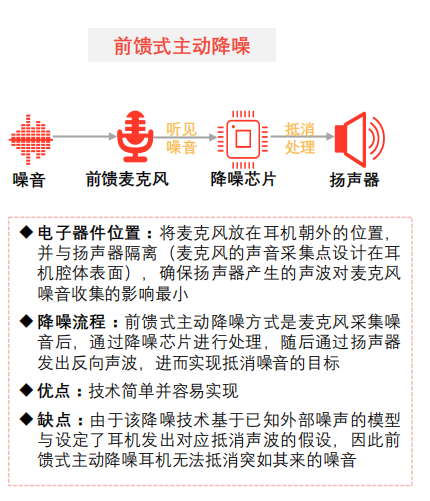

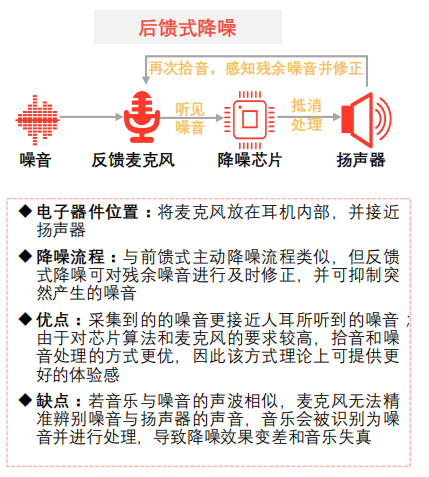

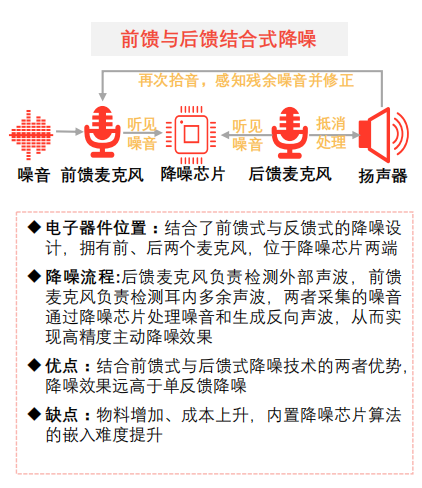

Active noise reduction modeIt is realized through the cooperation of hardware (chip, sensor, microphone array, etc.) and software algorithm. At this stage, the active noise reduction methods of TWS headphones mainly include ANC (active noise control technology) and enc (environmental noise cancellation technology).(1) ANC noise reduction technologyThrough the noise reduction system inside the headset, the reverse sound wave equal to the external noise is generated to neutralize it with the noise, so as to realize the noise reduction effect. Active noise reduction headphones are generally composed of a microphone responsible for capturing ambient noise, a noise reduction chip responsible for noise analysis and processing, and a speaker responsible for generating reverse sound waves;(2) Enc noise reduction technologyDouble microphone array is adopted to accurately calculate the speech position of the speaker, so as to protect the target speech in the main direction and eliminate the interference noise in the environment. Enc technology can suppress 90% of the reverse ambient noise and provide users with high-quality voice call effect. However, ENC technology requires high software algorithms and will increase the power consumption of the whole system. At present, apple airplads pro, Huawei freebuds3, oppo encow51, vivo Neo and other styles all adopt active noise reduction technology.

Three ANC active noise reduction technologies for TWS headphones

Related technologies of TWS earphone industry in China -- sensing interaction technology

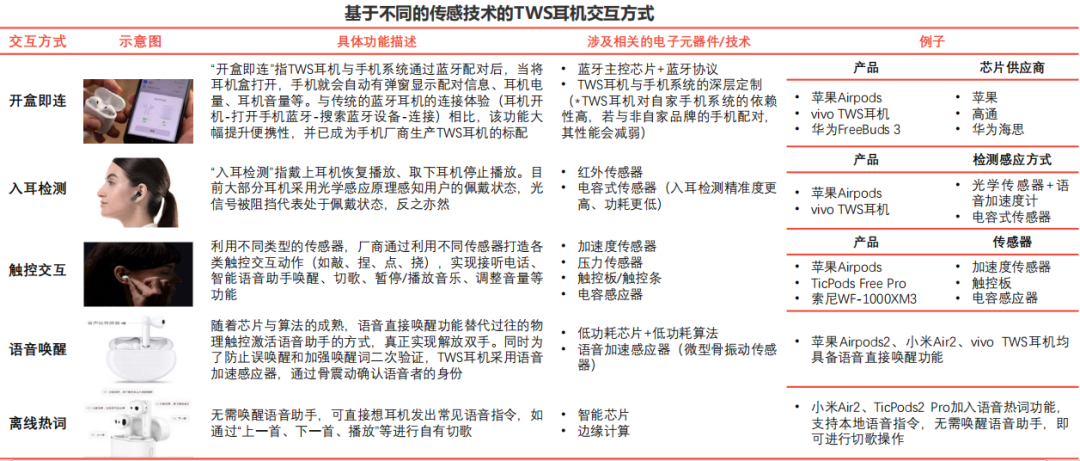

With the maturity of chip, sensor and AI algorithm technology, diversified interaction modes, such as open box connection, touch interaction, voice wake-up, in ear detection and off-line hot words, are gradually applied to TWS headphones.

Based on the integration of various technologies such as different chips, sensors and AI algorithms, TWS headphones have diversified interaction modes, such as open box connection, touch interaction, voice wake-up, in ear detection, offline hot words, etc.

Related technologies of TWS headset industry in China -- ble audio Bluetooth Technology

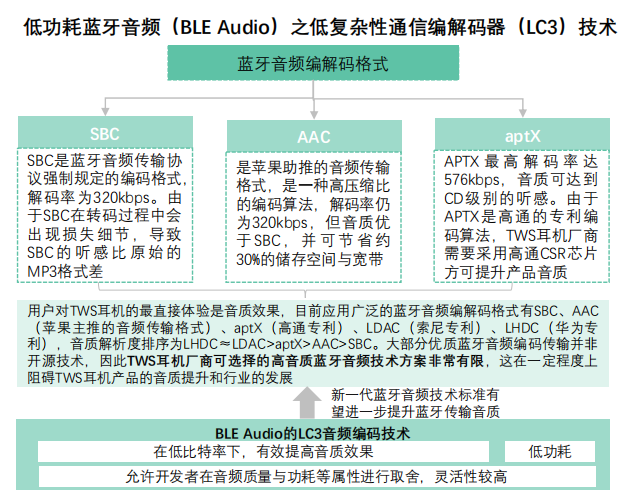

The new generation of Bluetooth audio technology standard ble audio has three technical features, which can bring innovative chip solutions and new functions to TWS headset products, and help accelerate the popularization of TWS headset industry.

Bluetooth standard mainly includesClassic Bluetooth and low power BluetoothAmong them, classic Bluetooth is mainly used for audio transmission (such as two-way voice call, one-way music playback, etc.), while low-power Bluetooth has the characteristics of low-power standby, which is mainly used for connection and pairing between devices. At this stage, most mobile phones, Bluetooth headsets and other mobile devices are generally used with classic Bluetooth and low-power Bluetooth functionsDual mode bluetoothChip. In January 2020, the Bluetooth special interest group (SIG) was officially releasedNew generation Bluetooth audio technology standard——Bluetooth LE Audio(low power Bluetooth audio, hereinafter referred to as ble audio), which means that the low power Bluetooth technology standard will support the audio transmission function. Ble audio has the advantages of low power consumption, wide connection range and low cost of single-mode Bluetooth chipToubao believes that in the future, single-mode low-power Bluetooth is expected to replace traditional Bluetooth. In other words, mobile electronic devices only need to use single-mode low-power Bluetooth chips.

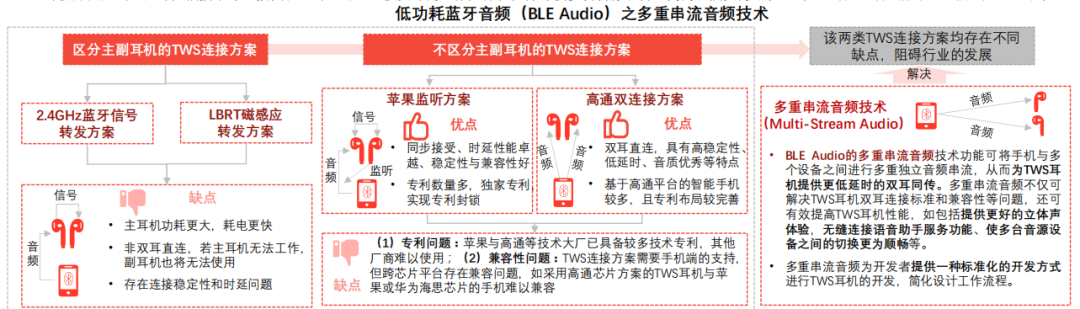

• ble audio has three technical features(support multi stream audio, broadcast audio and new audio decoder LC3), it can bring innovative chip solutions and new functions to TWS earphone products, and help accelerate the popularity of TWS earphone industry. The following describes the three technical features of ble Audio:(1) Multi stream audio technology: help to skip the technical threshold of Apple's exclusive monitoring scheme and provide developers with a standardized TWS headset development method. At the same time, the technology can directly realize direct binaural connection, provide better stereo experience, and make the switching between multiple sound source devices more smooth. (* broadcast audio and audio decoder LC3 technology on the next page)

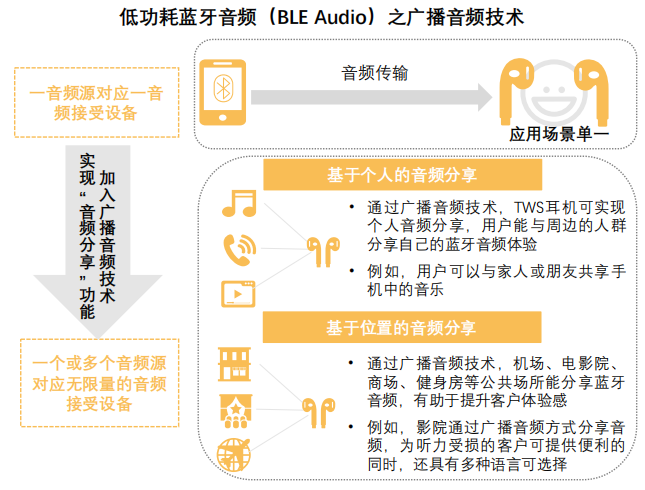

Broadcast audio technology: it can realize the audio sharing function based on people or location, break through the current single application scenario of "one audio source corresponds to one audio receiving device", and help to expand the application scenario of TWS headphones.

Global TWS earphone industry market scale

With the maturity of Bluetooth, chip, sensor and other technologies, TWS headset will accelerate its development and is expected to become the fastest-growing field of intelligent wearable devices. It is predicted that the global market scale will reach US $40.13 billion in 2024.

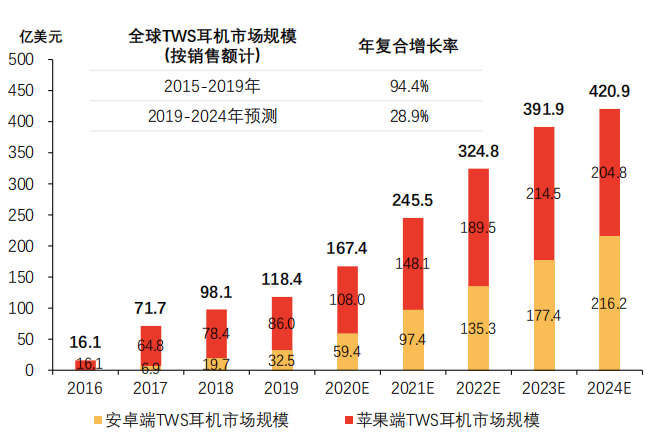

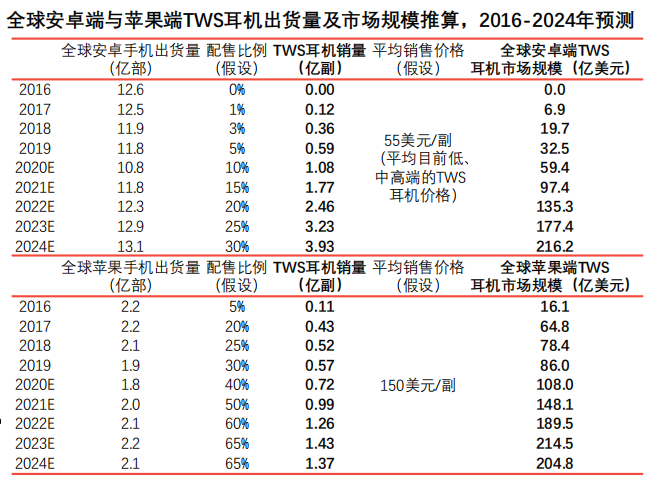

In September 2016, Apple released the first generation of airplads, which received a good market response due to its advantages of stable connection, low time delay and wireless. The launch of airplads has promoted the transformation of the headset industry and opened the era of headset wireless. The TWS headset industry has entered the stage of rapid growth from the embryonic stage. From 2016 to 2019, the global TWS headset market scale (by sales) increased from$1.61 billionIncrease to$11.84 billion, with a compound annual growth rate of94.4%。In the next five years, with the maturity of Bluetooth, chips, sensors and other technologies, and the growing demand for online office and online learning, the TWS headset industry will accelerate its development and is expected to become the fastest-growing field of intelligent wearable devices. It is predicted that the global market scale will reach in 2024$42.09 billion.

Market scale of TWS earphone industry in China

With the penetration of TWS earphones accelerating and becoming the mainstream standard earphone type of smart phones, China's TWS earphone market will maintain rapid growth in the next five years, and the market scale is expected to reach US $10.59 billion in 2024.

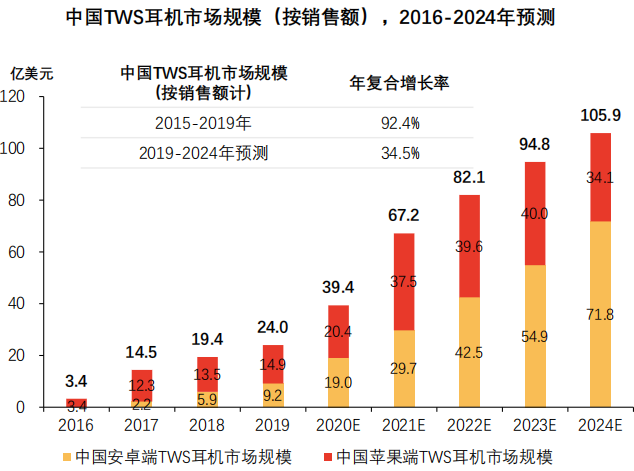

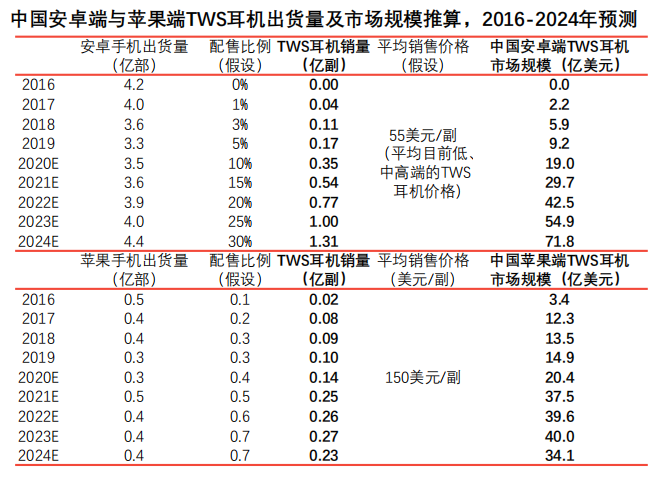

From 2016 to 2019, China's TWS headset market scale (by sales) increased from US $340 million to US $2.4 billion, with a compound annual growth rate of 92.4%, dominated by Apple's airplads. With the increase of market penetration, TWS headset will become the mainstream standard headset type of smart phones. China's TWS headset market will maintain rapid growth in the next five years, and the market scale is expected to reach US $10.59 billion in 2024. Toubao believes that after 2020, the market scale of China's Android TWS headset will exceed that of apple, mainly due to: (1) the large number of Android mobile phone users, and the shipment of Android mobile phones in China in 2019 is 11 times that of Apple mobile phones. With the performance optimization of Android TWS headphones, its market share will be greatly increased; (2) The price of China's domestic android end TWS earphones has more advantages, which is conducive to promoting consumers' trial experience and accelerating the market demand growth of China's TWS earphone industry.

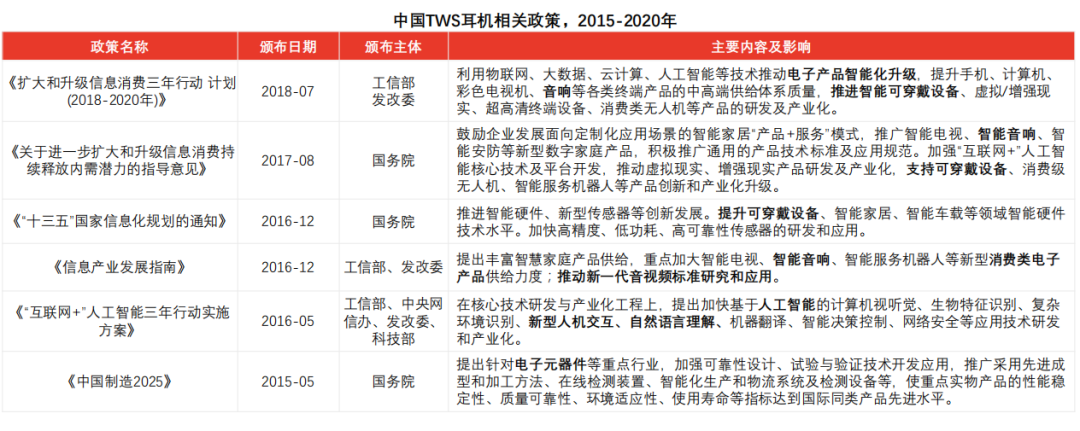

China TWS earphone industry - policy analysis

TWS earphones belong to the subdivided field of consumer electronics or intelligent wearable industry and belong to the industry encouraged by the state. Relevant Chinese departments have formulated a series of relevant policies to promote the development of the industry.

With the rapid development of informatization and intelligence, the next five years will be the core period for the upgrading of China's electronic technology and electronic products. The Chinese government strongly supports the development of electronic information industry. TWS earphones belong to the subdivided field of consumer electronics or intelligent wearable industry. They belong to the industry encouraged by the state and enjoy strong support from a number of policies. Over the past five years, relevant Chinese departments have formulated a series of relevant policies to promote the development of the industry:

China's TWS earphone industry - industrial chain analysis

TWS industrial chain mainly includes upstream main control Bluetooth chip, memory chip, battery and sensor suppliers, midstream complete machine manufacturers and packaging manufacturers, and downstream terminal brand manufacturers.

China's TWS industrial chain mainly includes upstream component suppliers, midstream complete machine manufacturers and packaging manufacturers, as well as downstream terminal brand manufacturers. Among them, the upstream is mainly composed of TWS headset and charging box, involving main control Bluetooth chip, storage chip, battery, sensor, MEMS microphone, etc; The whole machine manufacturers in the midstream have the ability to process precision components, mainly OEM / ODM OEM manufacturers; Downstream middle end brand manufacturers mainly include smartphone manufacturers, audio manufacturers, Internet enterprises, etc.

TWS earphone industry in China - upstream analysis of industrial chain

The main Bluetooth chip is the key to the signal transmission and sound quality performance of TWS headphones. Chinese Bluetooth chip suppliers mainly focus on the medium and low-end market, enter the market with low-cost competition, and there is still a certain gap with overseas manufacturers in technology.

Upstream - Master Bluetooth chip industry

Introduction to master Bluetooth chip:

The level of Bluetooth technology and audio codec technology determines the signal transmission effect and sound quality of TWS headset, and these functions are generally integrated in the main Bluetooth chip SOC, soThe main control Bluetooth chip is the key to the signal transmission and sound quality performance of TWS headset.The design of Bluetooth chip system is difficult, involving many technical fields such as audio, power supply, RF, baseband, CPU, software and so on. With the landing of the Internet of things scene and the performance upgrading of intelligent wearable devices, the design complexity and technical difficulty of the master Bluetooth chip will also be improved,Put forward higher requirements for the comprehensive technical capacity of chip enterprises.

Cost of master Bluetooth chip:

According to the investigation of cheetah, the master Bluetooth chip applied to TWS headsetCost proportionAbout10%-20%However, due to the different chip performance and market positioning,Single chipWide price range。 For example, the price of a single apple H1 main chip is as high as11 dollars(about 77 yuan). In 2019, the unit price of ordinary Bluetooth audio chip supporting TWS function of hengxuan technology is about6.1 yuan, the unit price of intelligent Bluetooth audio chip is abouttwelve point three oneYuan, while the prices of some medium and low-end Bluetooth chips have fallen to1.6 yuan。 With the maturity of the master Bluetooth chip industry chain,At present, the overall chip unit price also shows a downward trend, helpPromote the rapid development of downstream TWS earphone industryHowever, it dominates the Bluetooth chip marketThe competition will become more and more intense.

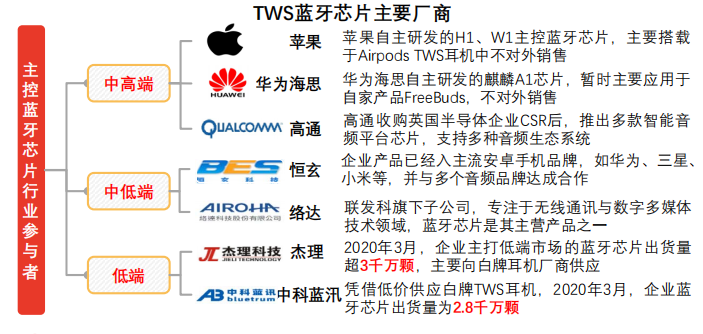

Main Bluetooth chip industry participants:

At this stage, apple airplads is equipped with an independently developed H1 chip. Before 2018, the main Bluetooth chip of Android TWS headset is mainly composed ofQualcomm, BES, airohaHowever, with the rapid development of TWS headset industry after 2018, the shipment increased significantly, and many chip manufacturers (such as Taiwan Ruiyu semiconductor, torch core technology, protophase technology, Ziguang zhanrui, huiding technology, etc.) successively joined TWS's main Bluetooth chip market. According to the statistics of I love audio network, as of November 2019,There are more than 16 Chinese TWS master Bluetooth chip manufacturers, with more than 49 chip types, a significant increase compared with the number of chip manufacturers (9) and chip types (16 models) in the same period in 2018.

Market competition pattern of master Bluetooth chip industry: according to the classification of market positioning, the Bluetooth master chip market can be divided into the following three echelons:(1)Medium and high end marketParticipants mainly include apple, Qualcomm, Huawei, Hisilicon and other manufacturers; (2)Middle and low end marketParticipants mainly include hengxuan technology, Luoda technology, Ruiyu, Ziguang zhanrui, etc; (3)low-end marketParticipants mainly include Jerry technology, Zhongke Lanxun, etc. In addition to apple and Huawei Hisilicon (mainly supplying their own products), at present, independent Bluetooth chips supply the products of C (CRS Qualcomm), B (BES hengxuan) and a (airoha Luoda) formed in the market"CBA" patternAmong them, Qualcomm's CSR series chips have the highest market share.

Overall, Bluetooth chip suppliers in ChinaIt mainly focuses on the middle and low-end market and cuts into the market with low-cost competitionIn terms of technology, there is still a certain gap with overseas manufacturers, which is conducive to promoting the popularity of TWS headset products in the short term. However, in the medium and long term, Chinese Bluetooth chip enterprises focus on the competition in the middle and low-end market, which is not conducive to the improvement of their technical level and profitability.

Upstream - Master Bluetooth chip industry

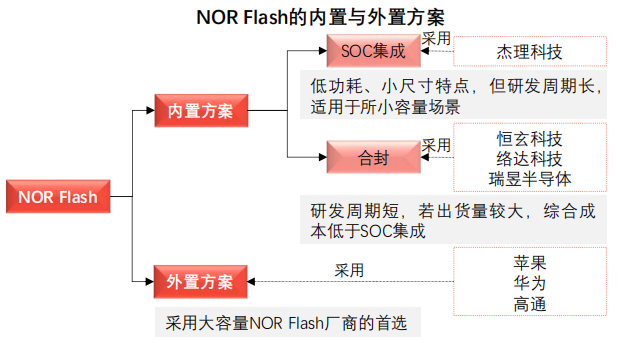

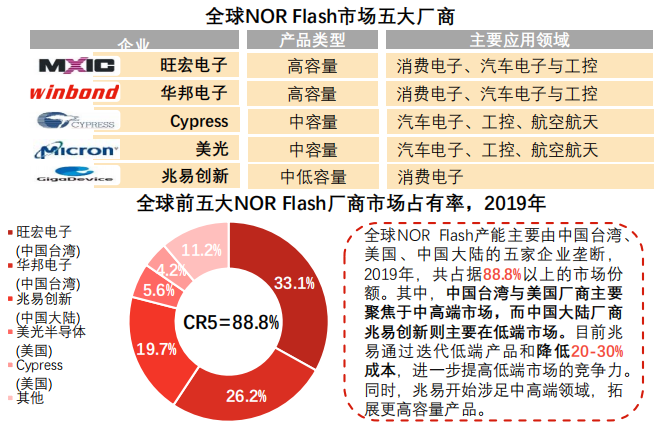

Upstream - memory chip (NOR Flash)

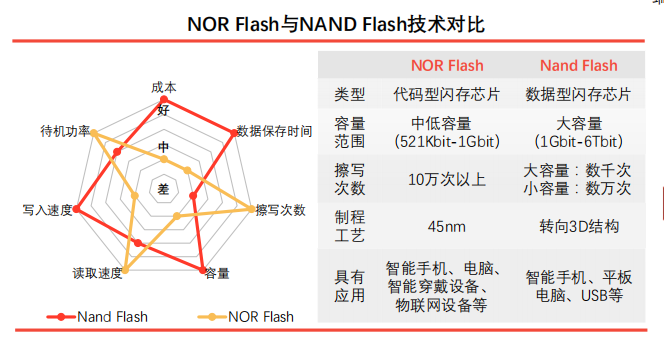

Introduction to memory chips: memory chips are generally divided into volatile memory chips and nonvolatile memory chips. Nonvolatile memory chips can be divided into nor flash and NAND flash:

(1)NOR FlashIt is a code storage chip, which has the characteristics of high reading speed, low standby power consumption, high reliability and long service life. It is suitable for mobile phones, intelligent wearable devices (such as TWS headphones, smart watches, etc.), Internet of things devices, televisions, automobiles and other code and some data flash memory fields;

(2)Nand FlashIt belongs to a data storage chip with large capacity storage and high writing speed. It is suitable for smart phones, tablet computers, USB and other fields.

Upstream - memory chip (NOR Flash)

NOR Flash Market Size:

The accelerated penetration and technology upgrading of the downstream TWS headset industry is one of the main driving forces for the growth of NOR flash demand, which helps to promote the market scale of NOR flash industry.

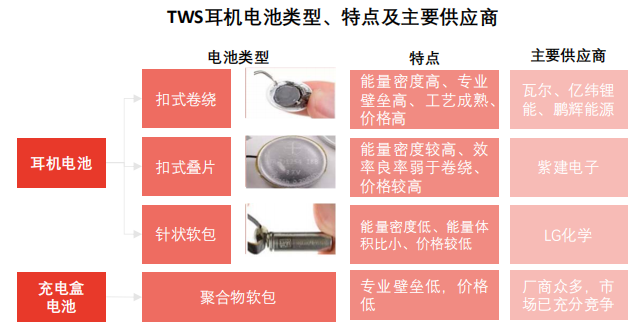

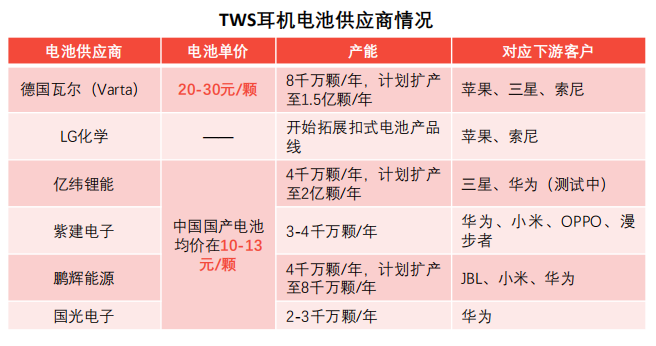

Upstream - battery

The lithium batteries used in TWS earphones are mainly divided into button batteries (button batteries are also divided into button winding and button batteries)LaminationTwo types) and needle soft pack battery, while the battery used in TWS headset charging box is mainly polymer soft pack battery. Compared with needle soft pack or polymer soft pack batteries, button batteries have the advantages of energy density, space saving and lighter weight. Many TWS headset models (such as apple airplads pro, Samsung Galaxy buses, Huawei freebuds3, Xiaomi air2, etc.) begin to use button batteries. ThereforeToubao believes that the button battery is expected to become the mainstream solution of TWS headphones。 Take Apple's airpods as an example. The airpods2 uses LG Chemical's needle battery with a capacity of 25mAh and can support 5-hour battery life. However, since the new generation product airpods Pro adds new functions such as active noise reduction and improves power consumption, it needs to be equipped with a larger battery capacity. The airplads pro with higher power consumption can support 4.5 hours of battery life by carrying a smaller varta 50mah button battery.

Benefiting from the large increase in the shipment of TWS headphones, the demand of micro battery industry also increased。 According to the counter point forecast,Market scale of micro battery industryFrom 20195.1 billion yuanGrowth to 2020RMB 9.4 billion, its button battery market share will increase from25%Growth to 202057%, the corresponding market share of needle soft pack battery will increase from48%Slide to18%。At this stage, the suppliers of button batteries are mainly Val of Germany, while Chinese competitors include Yiwei lithium energy, Penghui energy and Zijian electronics.In terms of price,According to the data of Gaogong lithium battery, the price range of batteries applied to high, medium and low-end TWS headphones at this stage is 15-20 yuan / piece, 7-15 yuan / piece and less than 5 yuan / piece respectively, and the average price of domestic batteries in China is 10-13 yuan.

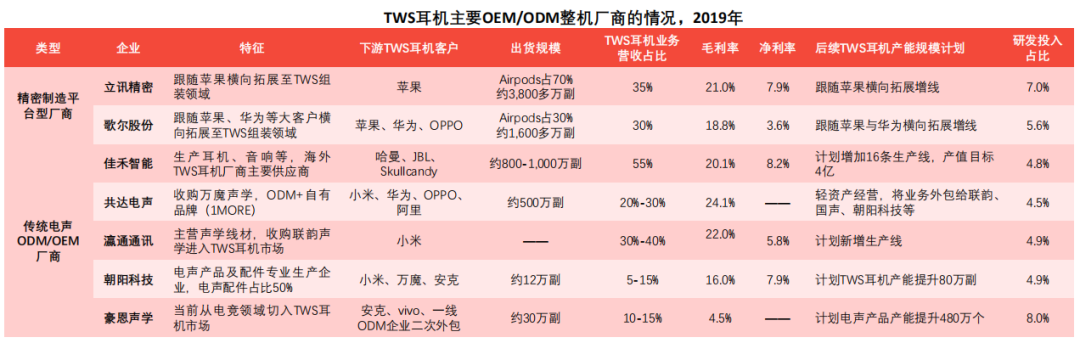

China's TWS earphone industry - midstream analysis of industrial chain

The downstream OEM / ODM machine is the most valuable link in the TWS headset industry chain, accounting for 40% of the cost. The main manufacturers include Lixun precision, goer, Jiahe intelligent, Gongda electroacoustic, etc.

Midstream - OEM / ODM complete machine manufacturer

In addition to upstream components, OEM / ODM is the most valuable link in the TWS headset industry chain, accounting for up to40%。 According to the research of cheetah, the overall cost of apple airplads is about600 yuan,Android TWS earphone brandThe average cost of the whole machine is about200-300Yuan.The main reason for the high cost of TWS earphone isCompared with traditional earphones, the internal structure of TWS earphones has changed greatly. In addition to the common sound generating unit with wired earphones, TWS earphones also add various transmission chips, sensors, storage chips, noise reduction modules and other parts. At the same time, the shape, volume and weight of the earphones need to be strictly controlled. This makes the manufacturing process of TWS headphones involve a large number of precision assembly processes and detection processes, such as the manufacturing process of Wanmo acoustic TWS headphones30 manufacturing processes and 12 test processesThus, the manufacturing cost of TWS earphones is high.

OEM / ODM manufacturers of TWS earphones can be divided intoPrecision manufacturing platform manufacturer(such as Lixun precision and Goethe, mainly Apple suppliers) andOEM / ODM manufacturers of traditional electroacoustic products(Jiahe intelligent, Gongda electroacoustics, haoen acoustics, etc.), the details of the supplier are shown in the figure below:

China TWS earphone industry - downstream analysis of industrial chain

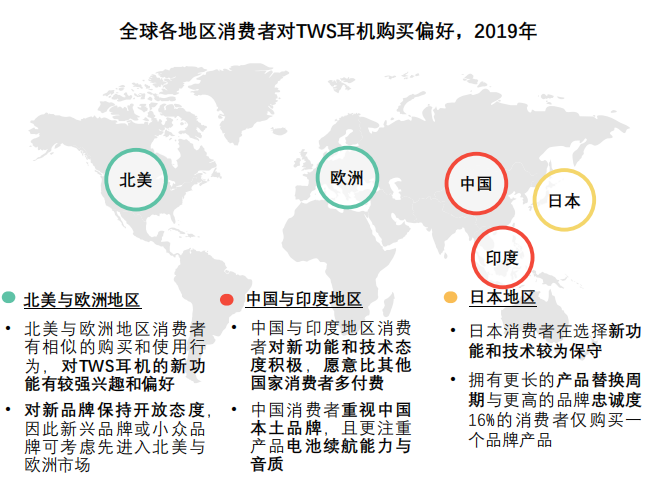

With the increasingly clear market prospect of TWS headphones, the industry market participants are gradually increasing, including mobile phone brand manufacturers, audio manufacturers and Internet manufacturers.

The downstream of TWS earphone industry chain is terminal brand manufacturers. In addition to Huaqiangbei white brand small manufacturers, large manufacturers in TWS earphone industry can be divided into three categories: mobile phone brand manufacturers (such as apple, Huawei, Samsung, Xiaomi, etc.) Audio manufacturers (such as Sennheiser, Sony, JBL, beats, rambler, Wanmo, etc.) and Internet manufacturers (such as Amazon, Google, Netease cloud, cool dog, iqiyi, etc.).

China TWS earphone industry - user analysis

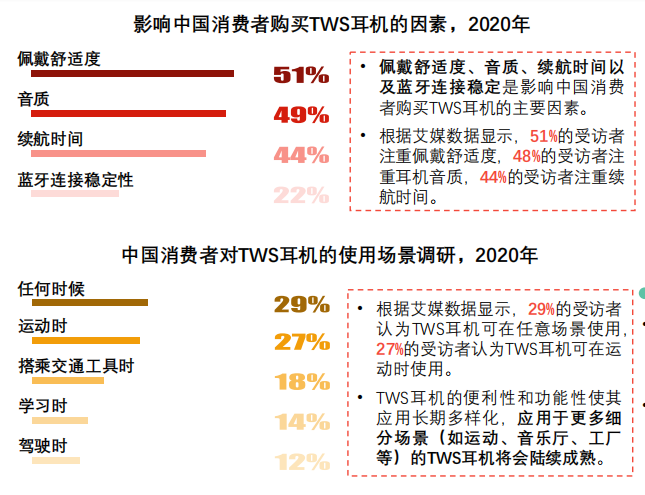

Wearing comfort, sound quality, battery life and stable Bluetooth connection are the main factors affecting Chinese consumers to buy TWS headphones.

The use scenarios of TWS wireless headset are diverse. It can not only connect a variety of electronic devices (such as smart phones, tablets, televisions, game consoles, laptops, etc.), but also be used in sports, learning, driving, work and other scenarios.With the improvement of TWS earphone endurance, transmission, sound quality, price and other pain points, consumers gradually develop the habit of using TWS earphones。 According to Qualcomm's 2019 global consumer audio product usage survey report, among the survey population,27%Consumers already own a pair of TWS headphones, about25%Of consumers plan to buy enough TWS headphones in the next year.

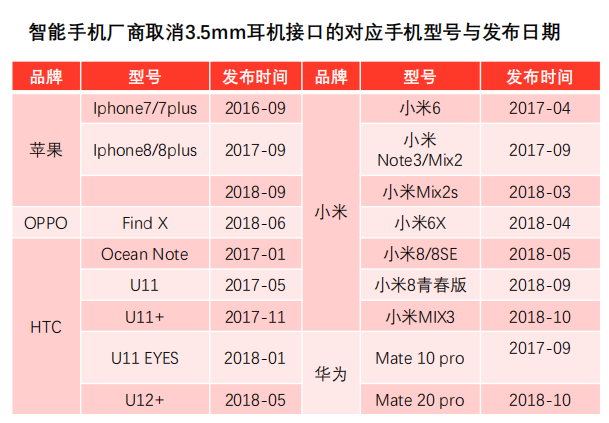

The cancellation of earphone interface, the driving factor of China's TWS earphone industry, promotes the development of TWS earphones

Under the background that smart phone manufacturers gradually cancel the 3.5mm earphone interface, the TWS earphone that can realize real wireless will accelerate its penetration and gradually become a general standard in the market.

The 3.5mm earphone interface of smart phone is cancelled to promote the wireless earphone and help the development of TWS earphone.

In order to improve users' experience of smart phones, smart phone manufacturers reduce the IOT buttons and interfaces of mobile phones to realize the characteristics of lightweight and waterproof of mobile phones. After Apple took the lead in canceling the 3.5mm headphone interface in the iphone7 Series in 2017, more and more flagship models of smart phone manufacturers (such as Huawei mate10 / P20, Xiaomi 6 / 8, etc.) have also successively cancelled the 3.5mm interface. Therefore, canceling the 3.5mm interface will become the development trend of smart phones in the future. The cancellation of the 3.5mm interface forces users to switch to wired headphones or TWS headphones with type-C / lightning interface, but it cannot realize the function of charging and listening to music at the same time. In this context, we can get rid of traditionDue to the physical wire bondage of headphones, TWS headphones with stereo system will accelerate the penetration, replace wired headphones and gradually become a general standard in the headphone market.

China's TWS headset industry - the upgrading of Bluetooth technology promotes the development of TWS headset industry

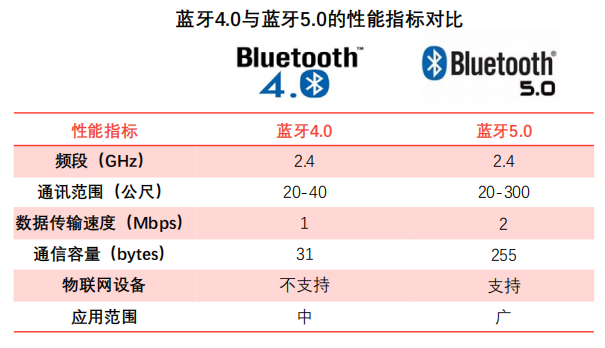

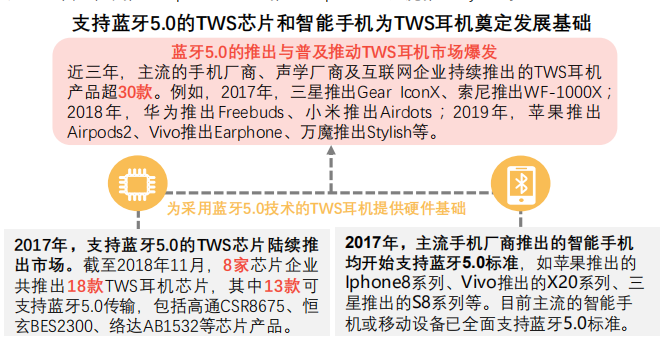

The launch and popularization of Bluetooth 5.0 meet the development needs of TWS headphones, significantly improve product performance and market competitiveness, and accelerate the development of TWS headphones industry.

The upgrading of Bluetooth technology promotes the development of TWS headset industry

TWS headphones mainly transmit signals through Bluetooth. However, due to the small volume, small battery capacity and other characteristics of TWS headphones, and the user's pursuit of headphone connection stability, endurance, sound quality and so on, soBluetooth connection technology with faster transmission speed, more stable connection capability and lower power consumption is one of the core technologies in the development of TWS headset industry.

The launch of Bluetooth 5.0 meets the development needs of TWS headset technology. In June 2016, the Bluetooth 5.0 technical standard was promulgated.Compared with Bluetooth 4.0,Bluetooth 5.0 technology improves the transmission speed by 2 times, the transmission distance by 4 times and the data transmission volume by 8 timesAnd maintains the characteristics of low power consumption and strong stability of Bluetooth transmission. Bluetooth 5.0 technology effectively improves the transmission quality of wireless signals, and enables TWS headphones to realize the function of bilateral communication (that is, two headphones can be used as main speakers), so as to improve the user experience and enhance the competitiveness of products.

In addition, since 2017, chip manufacturers and smartphone manufacturers have complied with the trend of TWS headset market and launched a series of TWS chips and smartphones supporting Bluetooth 5.0.The rapid popularization of Bluetooth 5.0 technology not only provides the hardware foundation for TWS headphones using Bluetooth 5.0 technology, but also accelerates the development of TWS headphone industry.In recent three years, mainstream mobile phone manufacturers, acoustic manufacturers and Internet companies have continuously launched more than 30 TWS headphones. For example, in 2017, Samsung launched gear iconx and Sony launched wf-1000x; In 2018, Huawei launched freebuses and Xiaomi launched airdots; In 2019, Apple launched airpods2, vivo launched earphone, Wanmo launched stylish, etc.

China's TWS earphone industry - the demand for product technology upgrading and upgrading promotes the development of the industry

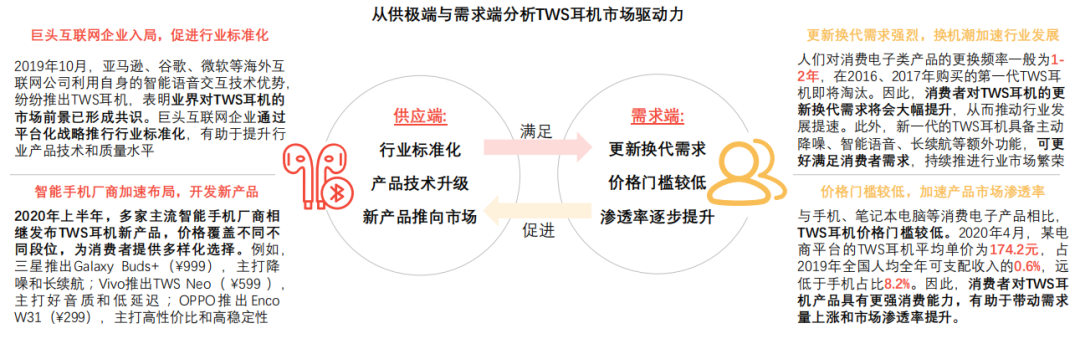

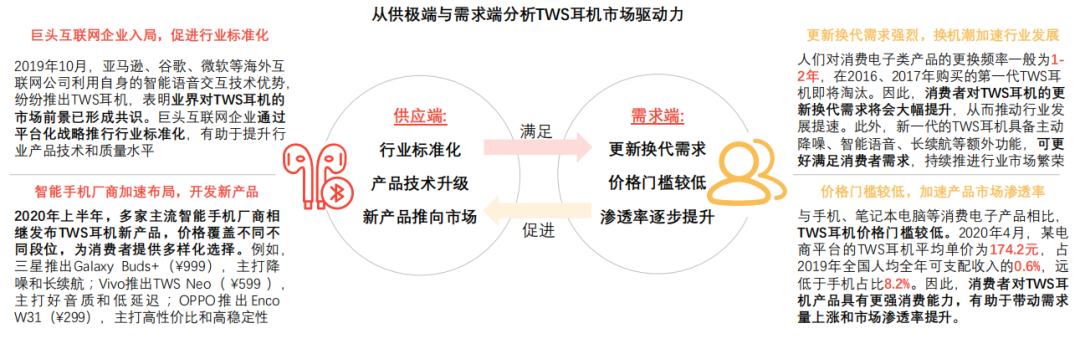

In the short term, although the TWS earphone industry is impacted by the epidemic, the medium and long-term industry market growth trend remains unchanged. The main reason is that the demand side and supply side of the TWS earphone industry work together to drive the TWS earphone industry to accelerate penetration and growth.

Analysis of TWS earphone market driving force from supply side and demand side

Under the influence of COVID-19 in 2020, the delay of reemployment and the stagnation of logistics, overlay the new shortage of TWS headset products in the first quarter, and so on.As a result, the sales volume of TWS headphones shrank in the first quarter of 2020.According to the data of TWS headphones collected by Southwest Securities on a mainstream e-commerce platform in February, the total sales of TWS headphones is670 million yuan, mom-14.1%; Total monthly sales realized3.207 million sets, mom-17.7%; The average unit price reaches 210 yuan, mom 4.5%.

In the short term, although the TWS earphone industry is impacted by the epidemic, toubao believes that the demand for TWS earphones in the second quarter of 2020 will gradually make up, and the medium and long-term growth trend of TWS earphone market remains unchanged. The main reason is that the demand side and supply side of TWS earphone industry work together to drive TWS earphone industry to accelerate penetration and growth, specifically:(1) Supply side:On the one hand, giant Internet companies have joined the board to promote industry standardization and product technology upgrading. On the other hand, mainstream smartphone manufacturers have accelerated the layout and launched new products at different prices to meet the needs of consumers;(2) Demand side: the low price threshold of TWS earphones and the strong demand for machine change have accelerated the increase of product demand and market penetration.

China's TWS earphone industry - the degree of intelligence will be gradually improved

With the gradual maturity of artificial intelligence technology, TWS headphones will gradually have independent perceptual computing ability, and its intelligence level will continue to be optimized.

TWS earphone technology continues to be upgraded, and the degree of intelligence will be gradually improved

After the pain points such as connection stability and delay of TWS headphones (i.e. wireless Bluetooth transmission problems) are basically solved, the technical level of TWS headphones will continue to improve (such as optimization of battery life time, improvement of headphone noise reduction effect, improvement of speech recognition accuracy, etc.), which is conducive to accelerating the iterative upgrading of TWS headphones and promoting the vigorous development of the industry.

In addition, with the gradual maturity of artificial intelligence technology, TWS headphones will gradually have independent perceptual computing ability, and its intelligence level will continue to be optimized. At this stage, the intelligent function of TWS headset is mainly combined with the mobile phone voice assistant of its own mobile phone brand, and the voice wake-up function is used to make a call, adjust the volume, cut songs and other operations. In order to meet the diversified needs of consumers, toubao believes that in the future, TWS headphones will be implanted with more sensors and more mature artificial intelligence algorithms to improve the richness of TWS headphone application scenarios and functions, such as health monitoring, accurate translation, content search, motion path recording, voiceprint recognition, identity confirmation, voiceprint payment, etc.

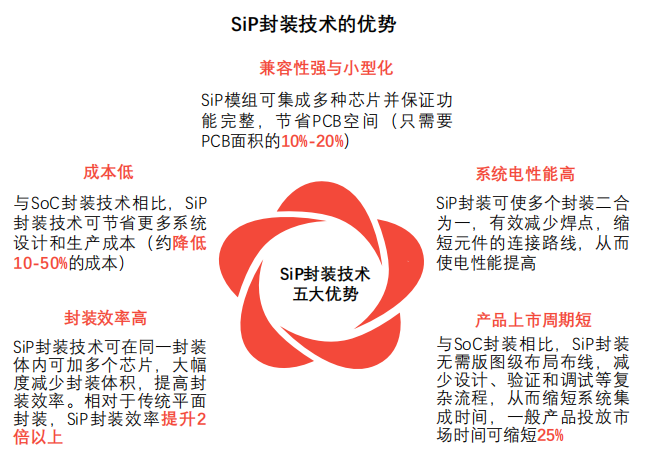

China's TWS earphone industry - SIP will become the mainstream packaging technology of TWS earphones

In order to meet the dual requirements of space and lightweight, the increase of sensors and functions of TWS headphones in the future will force the modularization of parts, and SIP will become the mainstream packaging technology of TWS headphones.

Under the trend of lightweight and modularization, SIP will become the mainstream packaging technology of TWS headphones

System in package (hereinafter referred to as SIP) is to integrate multiple functional chips into one package by side or superposition, so as to realize a basically complete function. In order to meet the dual requirements of space and lightweight, the increase of TWS headphone sensors and functions in the future will force the modularization of parts, and SIP will become the mainstream packaging technology of TWS headphones with its advantages of low cost, miniaturization, high performance, miniaturization and strong compatibility.

China TWS earphone industry - competitive landscape

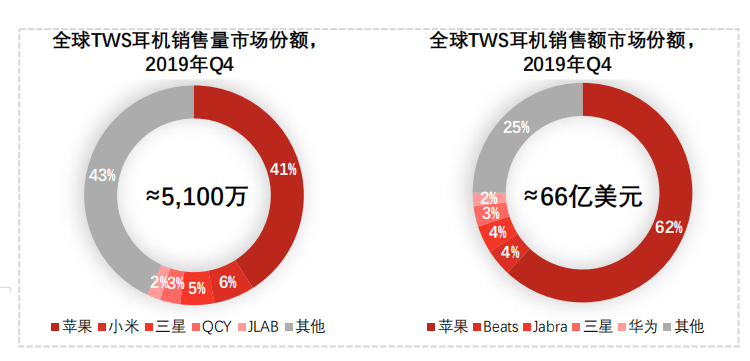

The market pattern of TWS headphones is similar to that of the era when mobile phones rose together, and the competition pattern is relatively scattered. The top three global shipments of TWS headphones are apple, Xiaomi and Samsung, accounting for 41%, 6% and 6% respectively.

Apple airplads is the main force in the TWS headset market, and Android brands are struggling to catch up.

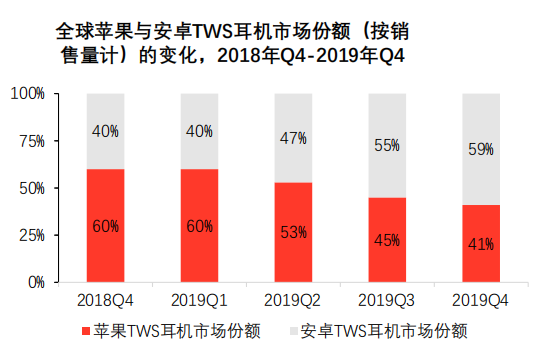

The TWS headset market can be mainly divided into apple and Android. Apple has established product price and performance standards in the TWS headset industry through the advance layout of TWS headphones, and won the first opportunity in market layout. However, the Android brand has been actively deployed in recent three years, and the shipment volume has continued to rise. According to the data from counter point,Apple's airplads market share is in a leading position, but the market share increased from60%Down to the fourth quarter of 201941%,Due to the improvement of Bluetooth transmission technology, Android TWS headset activates the demand of end consumers, and the market scale and share show an upward trend.

From the perspective of subdivided brand competition pattern, as of the fourth quarter of 2019,The top three global shipments of TWS headphones are apple, Xiaomi and Samsung, accounting for 41%, 6% and 5% respectively.With the new active noise reduction function of the latest airplads Pro headset, Apple has won the favor of consumers, accounting for the global TWS headset market41%Sales and62%Sales, ranking first in the industry; Xiaomi TWS headphones, on the other hand, attract price sensitive consumers by virtue of its "high cost performance" and brand advantages, ranking second. At present, the market pattern of TWS headphones is similar to that of the era when mobile phones rose together, and the competition pattern is relatively scattered. Although the market share of Android TWS headphones reached 59% in Q4 of 2019, Xiaomi, which ranked second in terms of shipments, accounted for only 6% of the market share. If we follow the evolution of smart phones and the maturity and standardization of TWS headset industry chain,In the future, TWS earphone industry will focus on big brand manufacturers.

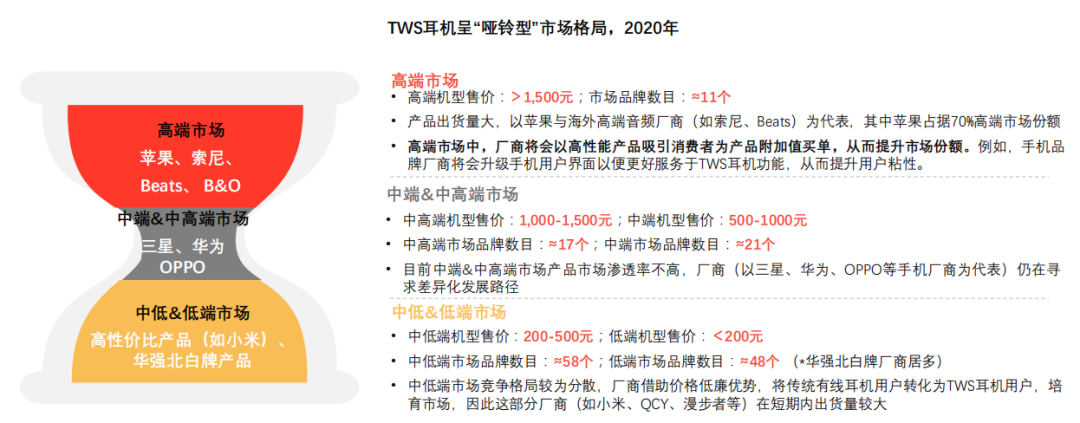

From the price segment of TWS earphone products,TWS earphone market pattern is dumbbell shaped (large at both ends and small in the middle)That is, the sales volume at both ends of the high-end market (the product price is more than 1500 yuan, represented by apple, Sony, Sennheiser and other products) and the low-end market (the product price is less than 200 yuan, represented by products with high cost performance or Huaqiang North white brand) is large, but in the middle and middle of the waist In the middle and high-end market (the product price ranges from 500 yuan to 1500 yuan, with Huawei and Samsung) the shipment volume is small. In the current "dumbbell" market pattern,The leading enterprises in TWS earphone industry and enterprises that mainly promote cost-effective products will enjoy the early development dividend of the industry.

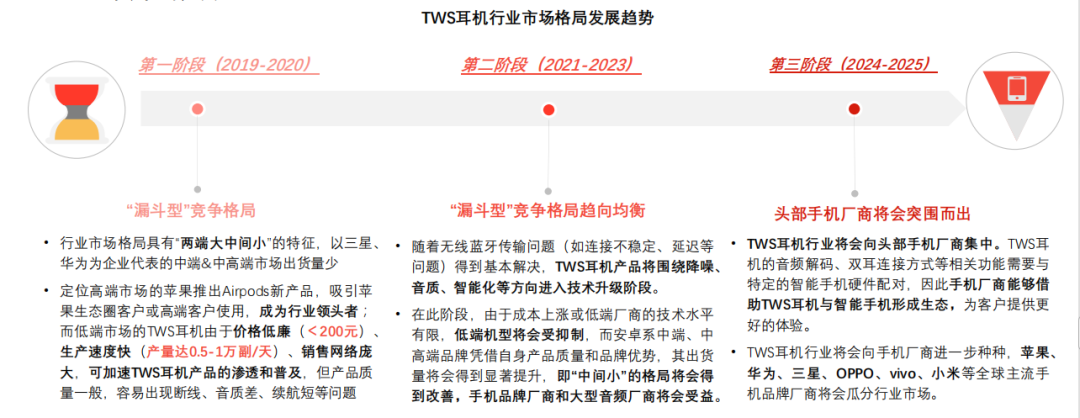

In the long run, toubao believes that with the upgrading of TWS headset technology and the maturity of the industrial chain, the future industry market pattern will go through three stages, from dumbbell to equilibrium, and finally to the head mobile phone brand manufacturers (such as apple, Huawei, Samsung, oppo, vivo, Xiaomi, etc.).

TWS earphone industry in China -- comparison of head Enterprises

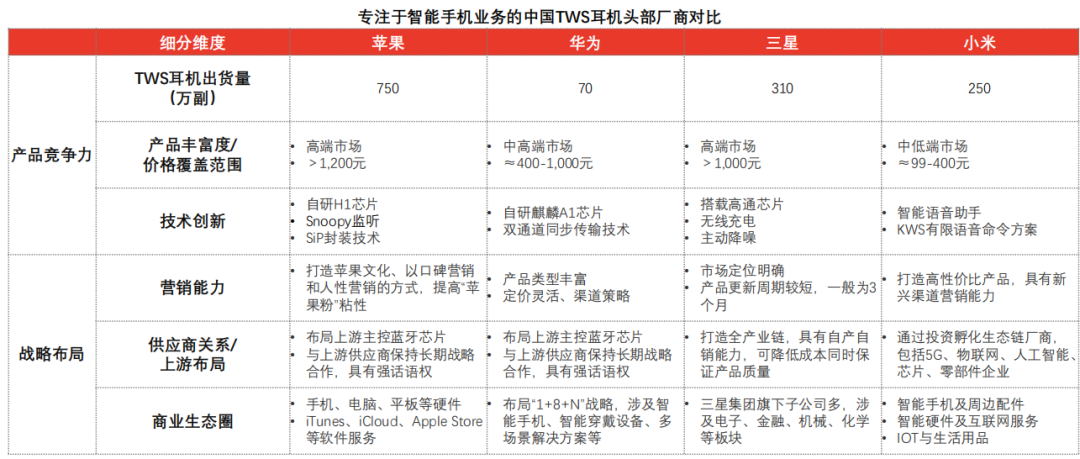

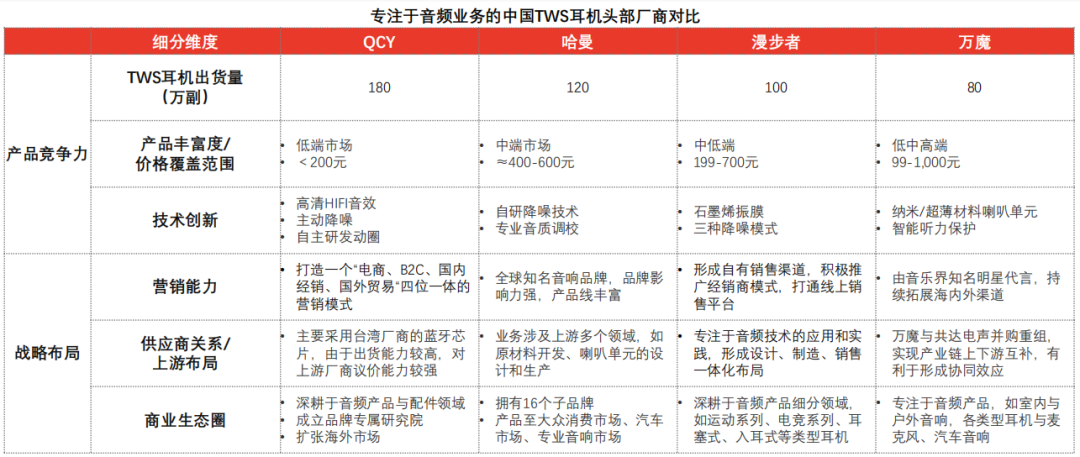

According to the six dimensions of TWS earphone shipment, product richness, technological innovation, marketing ability, supplier relationship / upstream layout and business ecosystem, this paper compares Chinese TWS earphone head manufacturers focusing on smartphone business.

China TWS earphone industry - enterprise ranking

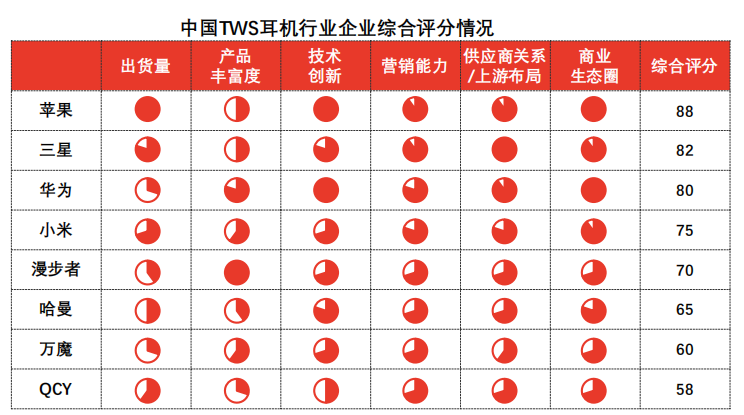

Compare Chinese TWS headphone head manufacturers according to the six dimensions of TWS headphone shipment, product richness, technological innovation, marketing strategy, supplier relationship / upstream layout and business ecosystem.

Ranking of manufacturers in China's TWS headset industry

This report compares the top enterprises in China's TWS headset industry according to the six dimensions of TWS headset shipment, product richness, technological innovation, marketing ability, supplier relationship / upstream layout and business ecosystem.

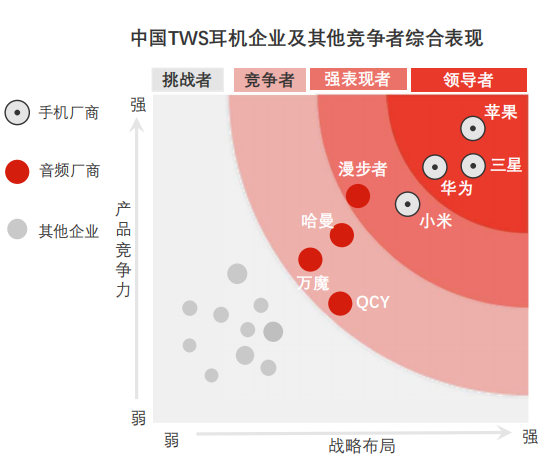

Apple, Samsung and Huawei are outstanding in six dimensions and are leaders in China's TWS headset industry; Xiaomi and rambler are strong market performers, and Harman, Wanmo and qcy are market competitors.

China TWS earphone industry - Enterprise Research

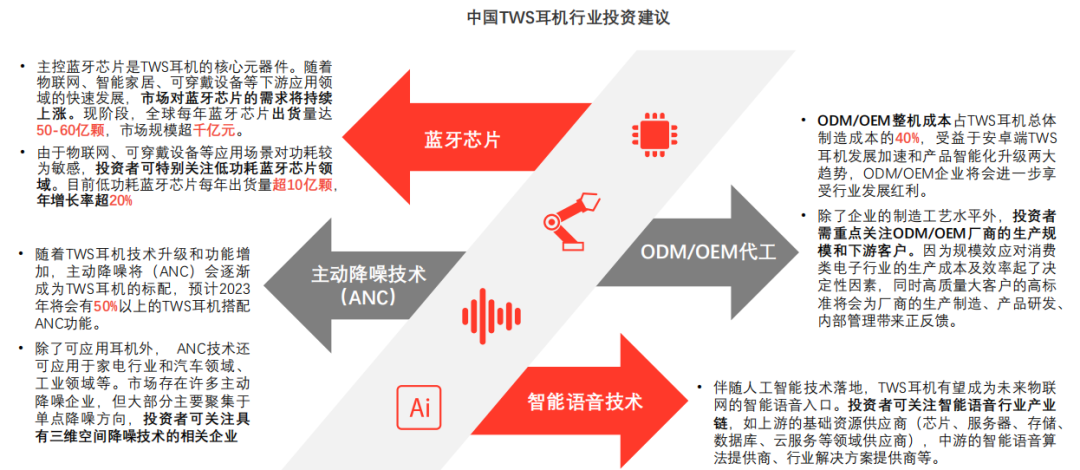

In the TWS headset industry, investors can focus on four related sectors: low-power Bluetooth chip, ODM / OEM OEM OEM, active noise reduction technology and intelligent voice technology.

China TWS earphone industry - investment risk

There are investment risks in China's TWS earphone industry, such as lower market demand and penetration than expected, intensified industry competition, lower than expected product R & D progress, etc.

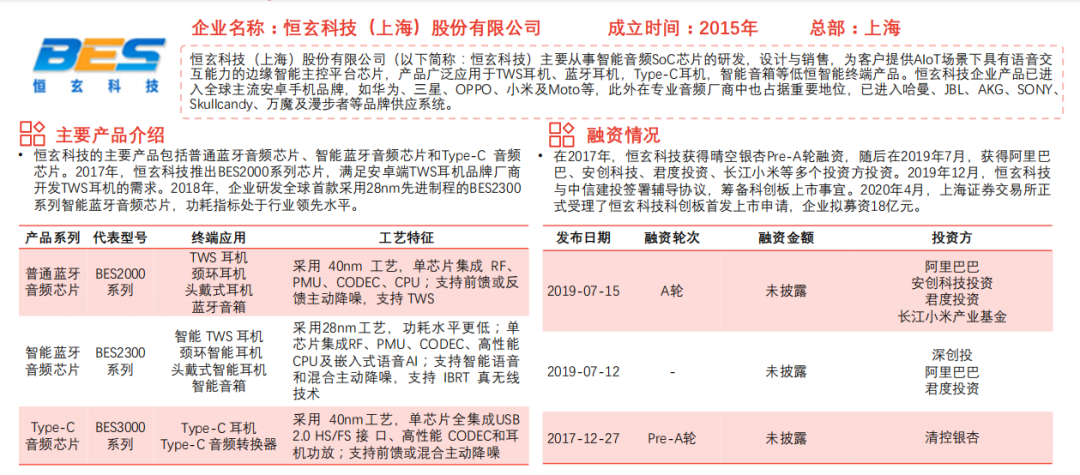

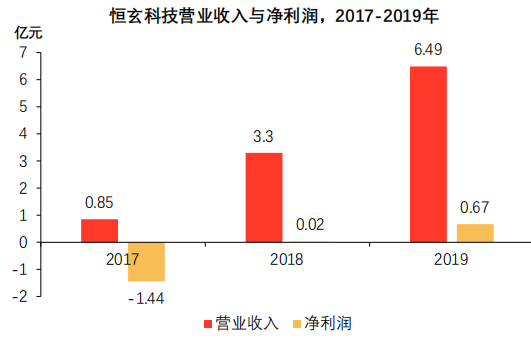

Recommendation of Chinese TWS earphone upstream enterprises - hengxuan Technology

Hengxuan technology is mainly engaged in the research and development of intelligent audio SOC chips. Its products are widely used in the field of intelligent terminals such as TWS headphones and Bluetooth headphones, and have entered the supply systems of many Android mobile phone manufacturers and professional audio manufacturers

Hengxuan technology focuses on R & D, has a number of patents and leading technical advantages, and gradually forms a stable customer group through long-term product technology iteration and market certification.

In terms of R & D and technology, hengxuan technology focuses on R & D and has a number of patents and leading technical advantages.

Attach importance to R & D and continue to increase R & D investment. In 2017, hengxuan technology was in the initial stage of development and invested in technology R & D on a large scale, with R & D revenue accounting for more than 53%. With the growth of revenue in the past two years, enterprises still maintain more than 20% of R & D revenue.

Patent competitive advantage as of April 2020, hengxuan technology has 39 patents, forming a core intellectual property system represented by binaural transmission, dual microphone noise reduction, multi-channel audio, master-slave switching and low-power Bluetooth audio.

It took the lead in launching the high-performance active noise reduction technology with independent property rights of active noise reduction Bluetooth single chip hengxuan technology. It is the first manufacturer in China to launch active noise reduction Bluetooth chip and realize mass production and shipment. At present, its products have been applied in many TWS headset brands such as Huawei, oppo and Xiaomi.

Investment highlight 2: form strong customer resource barriers

Through long-term product technology iteration and market certification, hengxuan technology has gradually formed a stable and mature customer group. At present, the enterprise has covered well-known brand customers such as Huawei, Harman, Samsung, oppo and Xiaomi. In addition, in the process of new product R & D, hengxuan technology and brand customers need to cooperate with each other and cooperate in R & D, which is conducive to creating a benign closed loop of product development between them, and then form a strong stickiness in the long-term cooperation.

TWS

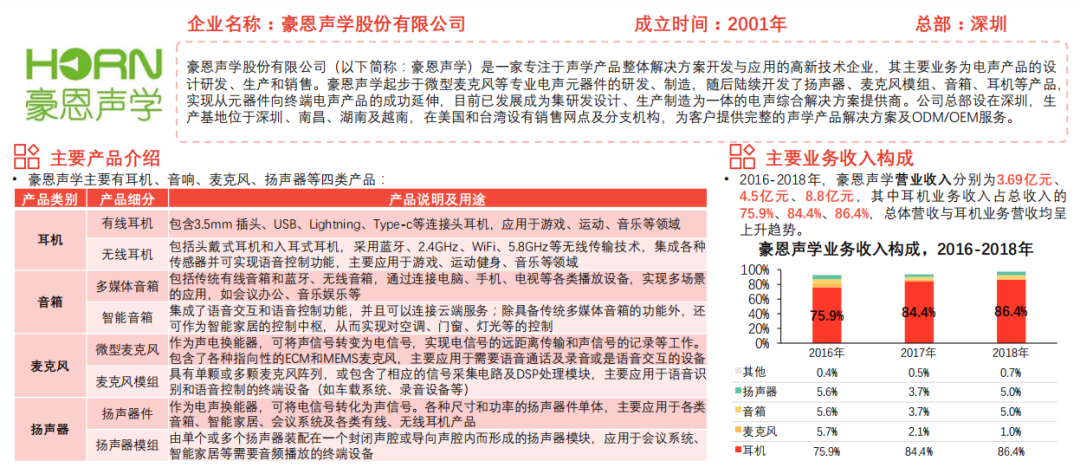

Recommendation of Chinese TWS earphone midstream Enterprises - haoen acoustics

Hengxuan haoen acoustics is a comprehensive electroacoustic solution provider integrating R & D, design, production and manufacturing. Its main business is the design, R & D, production and sales of electroacoustic products

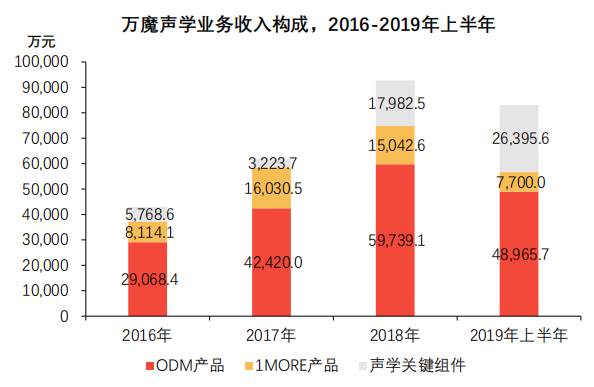

Recommendation of Chinese TWS earphone downstream enterprises -- Wanmo acoustics

Wanmo acoustics is a developer of music wearable accessories, focusing on acoustic R & D and design and intelligent software and hardware development. Its sales channels have covered dozens of countries and regions such as China, North America, Europe and Southeast Asia.

Different from the traditional cost plus sales model, Wanmo acoustics adopts the profit sharing sales model commonly used in Xiaomi ecological chain, that is, when the enterprise products leave the factory, they are sold to Xiaomi, a major customer, at the cost price. Xiaomi distributes the net profit obtained after product sales according to the agreed proportion. At present, the share proportion is about 50%. The sales model is conducive to stabilizing the product quality level of the enterprise. At the same time, it can bind the interests with the downstream major customer Xiaomi and share the industry dividend.

Investment highlight 2: high market recognition and significant brand advantages

Wanmo acoustics's free brand (1More) products have been sold to many countries and regions around the world, and have won awards at home and abroad for many times. It has a great market influence, which is conducive to providing important support for the future performance of the enterprise.

In terms of international brand influence, 1More won the Japanese VGP award in November 2016; At the Consumer Electronics Asia show in June 2019, 1More stylish fashion true wireless headset won the best audio product award at Consumer Electronics Asia 2019; Consumer report, a well-known authoritative media in the United States, lists Wanmo earphones as the first and second among the 186 famous brand competitors in the global earphone category, and focuses on recommending them to consumers.

In terms of Chinese brand influence, 1More Wanmo headset won the "top ten innovative enterprises in China's economy" at the 2018 China economic summit; In 2019, Wanmo acoustics won the "2019 Technology Innovation Award in audio industry"; In 2020, 1More won the top ten earphone brands in China in 2019.

This article is reproduced from“It's core language”, support the protection of intellectual property rights. Please indicate the original source and author for reprint. If there is infringement, please contact us to delete.

Copyright © Shenzhen Kinghelm Electronics Co., Ltd. all rights reservedYue ICP Bei No. 17113853